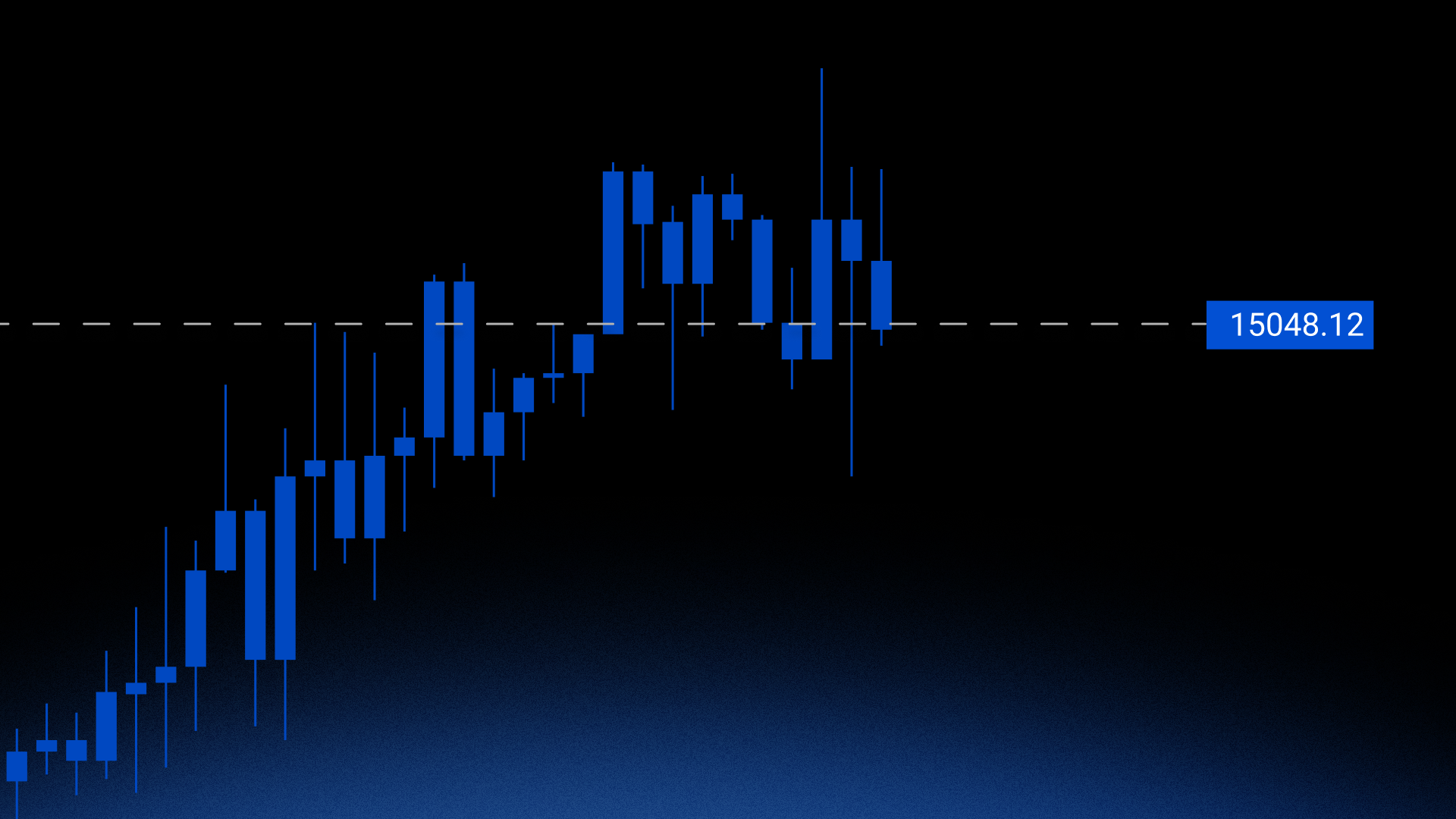

In the world of trading, understanding price movement is everything. Markets move in waves—sometimes calmly, sometimes with intense volatility. One of the most effective tools for measuring that volatility is the Average True Range (ATR).

Whether you’re trading forex, stocks, commodities, or crypto, ATR can help you make smarter decisions about risk, stop-loss placement, and trade selection. Here’s how it works and why you should consider adding it to your strategy.

What Is ATR?

The Average True Range (ATR) is a technical indicator developed by J. Welles Wilder. It measures market volatility, not direction. That means ATR doesn’t tell you whether an asset will go up or down—it tells you how much it typically moves within a certain period.

The default setting is 14 periods, which could be 14 days, hours, or even minutes depending on your chart.

How ATR Works

To calculate ATR, the indicator looks at the True Range (TR), which is the greatest of:

- Current high minus current low

- Absolute value of current high minus previous close

- Absolute value of current low minus previous close

This captures gaps, sudden spikes, and unusual ranges—giving a realistic measurement of how volatile a market truly is.

Then, ATR averages these True Range values over the selected number of periods.

High ATR = high volatility

Low ATR = low volatility

This simple output helps traders adjust position sizing, stop losses, and expectations.

Why ATR Is Valuable to Traders

1. Better Stop-Loss Placement

One of the biggest mistakes traders make is setting stop-losses too tight or too loose.

ATR helps you set stops based on the market’s actual behavior.

- If ATR is high → wider stops make sense

- If ATR is low → tighter stops are appropriate

A common approach:

Stop-Loss = Entry Price ± (ATR × a chosen multiplier)

For example, many traders use 1x ATR or 2x ATR.

This prevents your trade from getting stopped out by normal fluctuations.

2. Smarter Position Sizing

Volatility affects risk. With ATR, you can size your positions so that each trade carries similar risk.

For example:

- In high volatility conditions (high ATR), reduce position size

- In low volatility conditions (low ATR), increase size if appropriate

This keeps your risk consistent across different market environments.

3. Identifying Market Conditions

ATR gives you a quick way to read the market environment:

- Rising ATR → market becoming more volatile (breakouts, news, trend reversals)

- Falling ATR → market calming down (ranging, consolidating)

This helps you choose the right strategy:

- Trend traders prefer periods where ATR is rising

- Range traders prefer low ATR environments

4. Finding Breakout Opportunities

A sudden spike in ATR often signals:

- A potential breakout

- Increased participation from big players

- The beginning of a new trend

Some traders combine ATR with breakout systems to confirm that a move is strong and not a false signal.

Should You Use ATR?

Absolutely—especially if you care about risk management (and you should). ATR gives you:

- Realistic expectations of price movement

- A consistent method for setting stops

- Improved risk control

- Insight into market volatility

It’s simple, flexible, and enhances almost any trading strategy.

ATR won’t predict direction, but it will keep you grounded in reality. And in trading, that’s often the difference between success and failure.